Table of Content

Due to the Level 3 Snow Emergency declared in Licking County, our Johnstown and Newark branches will be closed today. All other locations will continue to operate under normal business hours. Hoosier Heartland State Bank is a full-service bank with locations throughout West Central Indiana. If the interest is tax-deductible, it reduces the net cost of borrowing. Compare the loan fees and costs among your different loan choices. Your loan could be approved in a relatively short time.

There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. We are New Zealand’s leading reverse mortgage provider. Since 2004, we have helped more than 20,000 Kiwis enjoy more freedom in retirement. Our Money Matters Small Dollar Loan Program can assist you in building or repairing your personal credit. When you are ready to begin evaluating a home equity loan, there are steps that you should take to make the process a smooth one. A variable interest rate that is lower than most other consumer loans, so you save money.

Mortgage Loan Application

We’re proud of our New Zealand heritage, which stretches back to 1875, and have been helping Kiwis over 60 to release equity from their homes since 2004. We put our customers first and are committed to going the extra mile to provide you advice and guidance through each step of the process. Interest is calculated on the balance outstanding and added to your loan. We’re here to help make your life easier with a variety of personal loan options. We are not endorsing or guaranteeing the products, information or recommendations provided by the organizations linked to our website.

This option allows you to use the equity in your home rather than other higher interest products. If you’ve done your homework, you realize that you can actually make your home work for you! The amount required to repay your loan will never exceed the net sale proceeds of your property. You can continue to stay in your home and enjoy the benefits of your community for as long as you want. If you have a certificate of deposit or savings account, you can use it as collateral for a loan.

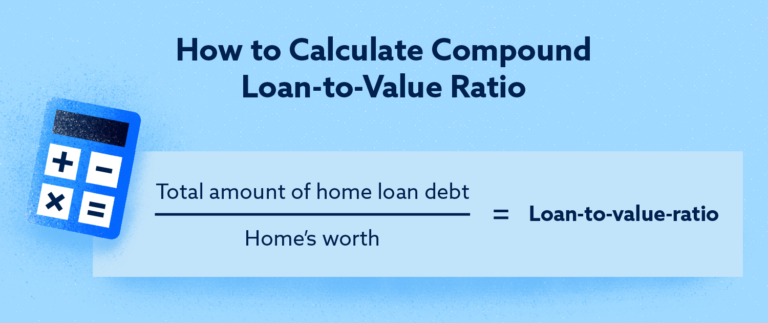

With a loan, you’re taking out money one time and paying it back over a few years.

If you choose to get a home equity loan with your current lender because they can give you the best deal, you could save money on the fees. And, the process can be smoother since the lender already has information about you. You also may not need to get a new appraisal on your home when you apply for a home equity loan with your current lender. However, this may be a rare occurrence in these days of fluctuating real estate values.

By borrowing against the equity in your home, you create a line of credit that you control. The mortgage lenders at Heartland Bank help you identify the mortgage program that is right for your needs and cash situation. From fixed-rate and adjustable-rate mortgages to needs-based mortgage programs, Heartland Bank is here to help you make homeownership a reality. Mobile Banking allows you to check balances, transfer funds, pay bills, receive alerts, and deposit checks all on your computer or mobile device.

Personal Loans

After you have reviewed your loan options and found the package that makes financial sense, it is time to proceed with the application. Most home equity credit lines are divided into two periods—a draw period and a payback period. A draw period—the period of time you are able to draw from the credit line—typically lasts from 10 to 15 years. The payback period is the period of time you have to pay back the outstanding balance. Life’s big events such as purchasing a home, getting a new car or paying for home improvement projects often require more money than you have on hand. From mortgages and home equity loans to installment and student loans, Heartland Bank is here to help you plan for and achieve the big things in life.

Taking out a bigger loan will mean higher monthly payments. A home equity line of credit is a revolving line of credit with a pre-established limit for you to draw out when you need it. This creates a flexible repayment schedule based on the balance of your HELOC. A fixed rate on your home equity line of credit assures you that your rate will not change. These loans come with a fixed interest rate for the life of the loans, and the loan terms can be tailored to meet your financial needs.

Second Mortgage Fixed

We can't stress enough that it is dangerous to frivolously tap the equity in your home. After all, your home is probably the most valuable asset you own. Due to recently increased security requirements, we at Heartland Bank are no longer able to support version 10 or older of Internet Explorer. We are sorry for this inconvenience, and encourage you to upgrade to more secure options such as Internet Explorer 11, Google Chrome, or Mozilla Firefox.

Rather than a set amount, you’re using the equity in your home to open revolving credit. You can borrow money with this Line of Credit multiple times. Many people like this type of account for unexpected expenses, rather than using a higher interest credit card. Lines of Credit give you the comfort of knowing you have cash ready when you need it. Funds are accessed by check, giving you easy access to cash when needed.

Low down payments allow you to make your purchase without having to dip into your savings account. At first glance, it seems that a line of credit is the best way to go. It offers you flexibility; you don't have to saddle yourself with debt that you may not have a use for right away.

You always have three business days to back out of the loan after it has been approved. You only pay interest on what you borrow, not on the entire line of credit. Interest is usually a variable or adjustable rate, which can vary as often as monthly. The technical storage or access that is used exclusively for anonymous statistical purposes. Got a home equity loan somewhere else — even at a bank?

We advise you to consult the privacy policies contained on third party linked websites. Heartland Bank assumes no responsibility nor does it control, endorse or guarantee any aspect of your use of the linked site. A Heartland Bank Equity Loan may be your solution as you research options to meet your specific financing need.

A home equity loan from Heartland is the smart way to borrow. To contact a Heartland banker or apply online, clickhereor visit any one of our localbranches. Funds are available whenever you need them without going through the loan approval process multiple times. We are providing a link to this third party website for your convenience. Heartland Bank is not responsible for the overall content of any website or the collection or use of information gathered on a third party website.

You don't need to contact the bank each time you want to make a draw against the line of credit. A home equity line of credit is as easy as writing a check. The line is available whenever you need it, and you pay no interest until you use the line. Plus, as you pay back what you borrow, the money goes back to your line to be used again.

No comments:

Post a Comment